Digital Money Has Redefined the Business Marketplace

I am not a financial expert, nor a financial advisor, nor a business or economics major who can fathom the world of digital money and analyze its impact on world economics and lifestyle. However, we can demystify this new age of "magic internet Money" in order to understand how the blockchain functions and effects our daily lives, and to make an informed decision about joining paid to click sites and faucets to collect bitcoin.

Let's Demystify this New Age "Magic Internet Money"

Digital money is a synonymous term for digital currency, virtual currency, and cryptocurrency. No single and central institution, nor does one person or business control and monitor digital money. This is what is meant by the popular terminology used to define bitcoin as a "decentralized virtual currency."

To pictorially paraphrase using an analogy of bitcoin as an 'entity' that gives birth to 'other entities' which in turn, churn out more 'offspring' are the various coins created on the mother blockchain. These secondary entities and their alternative offspring are the different altcoins created to finance new projects or innovations of products and services in the digital marketplace.

Any person, business, agency, or government can create a digital currency to finance and promote products or services. This is the business of altcoins, or the 'alternative coins' derived from bitcoin.

The Evolution of Digital Money: Unpacking the Bitcoin Family Tree

There is a hierarchy to digital money in the family of Bitcoin. All crypto other than Bitcoin are 'altcoin.' The word 'altcoin' is an abbreviation for Bitcoin Alternative. The five most widely considered important altcoins at the onset of Bitcoin were Litecoin, Dogecoin, Dash Coin, Dark Coin and Prime Coin.

Bitcoin in itself is a diverse portfolio of altcoins that have a fluctuating market value in the world of finance, and these altcoins are gradually redefining both the world of finance and our lifestyle.

It is not uncommon for people to be over-whelmed by bitcoin's ever-changing nature with the introduction of Non-Fungible Tokens and Token Securities in financing, or Digital Music and Streaming Rights for creating digital products and services in the music industry, or In-Game Skins and items for digital assets in the gaming industry, and the list is growing.

Individuals, companies, agencies, countries, and even the 'man on the moon' (if he exists,) can create a coin to market on the exchange to fund a business venture. And in this aspect, Bitcoin is indeed "magic money."

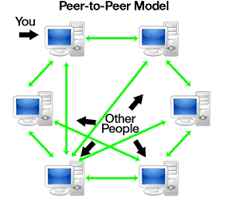

The upside to using Bitcoin are plenty: expediency due to borderless and peer-to-peer transactions; lower transaction fees for the exchange of crypto instead of traditional money; efficiency by eliminating intermediary parties in bitcoin transactions. However there is a downside which ironically contradicts the purpose and function of Bitcoin as a decentralized currency in the marketplace.

The fact that there isn't any 'central authority to monitor and govern bitcoin transactions' means that people need to do this for themselves. You need to screen for credibility of new coins from the mother blockchains; research the blockchain; monitor the stability of crypto coins; and invest wisely as all crypto transactions are performed person-to-person, or "peer-to-peer."

As a virtual currency, bitcoin is designed to facilitate "peer-to-peer transactions," or the exchange of crypto as in payment for a product or service, an investment in a project, an online payment or withdrawal, and even deposits to direct wallet addresses on the exchange. Peer-to-peer transactions mean that there is no banking intervention in making a payment or receiving payment from one person to another, or from one institution to another.

What is the Legal Framework: Enforcing Payment Guarantees in Bitcoin Agreements

Is there any guarantee that if you have entered such an agreement that both parties will follow through on their promise of payment or receivership?

There is no central and trusted authority such as a bank or treasury department to control, manage, and monitor digital money, electronic digital money transactions, and complaints. All crypto transactions are "peer-to-peer" including transactions at crypto exchanges. The trustworthy reputation and registered company status, the use of scam advisory and fraud websites to screen for legitimacy and credibility, and records of bitcoin transactions on blockchains are the means available to safeguard against scams, theft, and fraud.

Blockchains Are Records of Bitcoin Transactions

Blockchains are records of bitcoin transactions verified by network nodes (which include several network node confirmations to complete a single crypto transaction.) The blockchains are financial records that are public record. All crypto transactions can be traced and the transaction is open to the public view.

You can track crypto transactions, but what does one do in case of theft, fraud, misplaced or missing funds?

This is why it is so important to select a crypto exchange that has an excellent reputation for customer service, transparency, credibility, and accountability. This has been my user experience with Coinbase. There are many reputable and trustworthy crypto exchanges online. Do your own research to find an exchange that meets your needs.

Bitcoin Uses "Border -less" Transfers of Ownership

"Borderless" can be explained in the following way, "Bitcoin transactions allow people to transfer ownership of Bitcoin across the world without being restricted by national borders."

It's expedient or fast for online purchases and payments, but what are the risks for more substantial purchases and payments such as real estate. What can be done about legal problems that stem from international disputes about property ownership once the transaction has been complete? Different countries have different legal systems, property titles, and regulations. How exactly do Bitcoin transactions figure into these issues? Have legal systems updated to include the purchase and selling of property or assets using Bitcoin?

There are Advantages to Using Bitcoin

Electronic transactions make Bitcoin transactions fast, and the lower transaction fees make Bitcoin preferable to traditional fiat. Bitcoin is used to make purchases off-line as well as online. Anyone with an internet service can send and receive Bitcoin which makes it expedient and versatile. For all of the above reasons, Bitcoin is steadily becoming the preferred currency for international transactions.

Crypto for Clicks

You should start clicking ads for crypto; it too is FREE money that you can use to shop at online stores that accept Bitcoin, Litecoin, Dogecoin, and other alternative coins.

You can use bitcoin and altcoins to shop, make payments, invest and trade.

You can convert coins to cash on the crypto exchange for short-term cash flow, and store them on the exchange for long-term investment.

Bitcoin may be a limited supply, but the 'halving' of alternative coins on the exchange just adds to its value.

The volatility of the market value of bitcoin and alternative coins require you to monitor your diverse portfolio of crypto on the exchange.

Nevertheless, Bitcoin can become a means to build wealth. It is worth clicking ads in sites and faucets to collect satoshi (bits of crypto) to store on the exchange. The market value of Bitcoin may fluctuate, but it's still worth a nice sum of money. Bitcoin market value has reached as high as $30,000 US dollars and it is expected to climb even higher. The market value of alternative coins also fluctuate and steadily increase. Buying low and selling high is another way people have made money from trading bitcoin and altcoins on the exchange. Or converting coins to cash, and steadily depositing cash into a savings account at a bank; this is another way to build a nice "nest-egg" of savings which you can periodically fund with cash for long-term security or for a substantial purchase as in real estate.

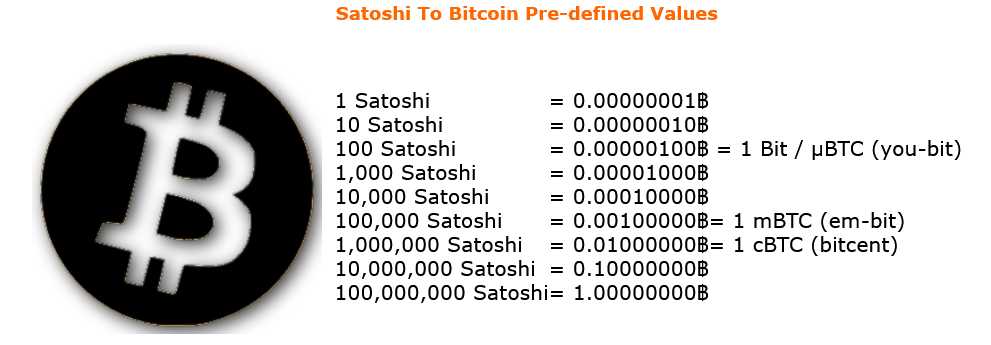

It's worth the time and effort to collect satoshi (bits of crypto) in sites and faucets, and to use the benefits and features in crypto exchange platforms to build wealth.

Sign up with an exchange in order to generate bitcoin and altcoin wallet addresses. These are referred to as "direct wallet addresses" that are used to electronically store coins.

Link these address to a micro-wallet (like Faucet Pay) to collect bits of satoshi from sites and faucets. When you have a substantial amount of crypto that satisfies the minimum deposit requirement of the crypto exchange (like Coinbase), you can transfer the lump sum of satoshi to your direct wallet on the exchange for safe-keeping, investment, or to convert coins to cash.

Browse our Portfolio of sites and faucets to start collecting FREE "magic internet money."

Different crypto exchanges have different guidelines in regard to daily limits for deposit and withdrawal, and the minimum amount of acceptable deposit or withdrawal. Here's a scale to understand the ratio between the number of satoshi in bitcoin value.